b&o tax wv

Until that time businesses may pay their taxes by visiting city hall. Charleston West Virginia is a great place to live work and play.

West Virginia Sales Tax Rates By City County 2022

BOT-300F Tax Return for Synthetic Fuels.

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

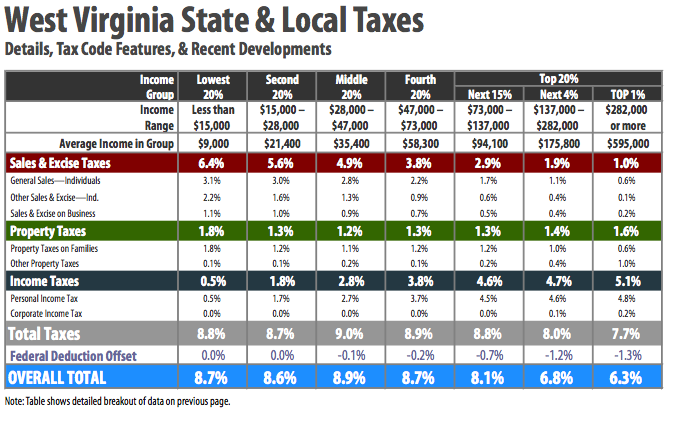

. BO Tax is measured by the application of rates against values of products gross proceeds of sale or gross income of the business as the case may be. City of Fairmonts ordinance number 1655 with an effective date of October 8 2015 provides for the imposition administration collection and enforcement of a Consumers Sales and Service. It is measured on the value of products gross proceeds of sale or gross income of the business.

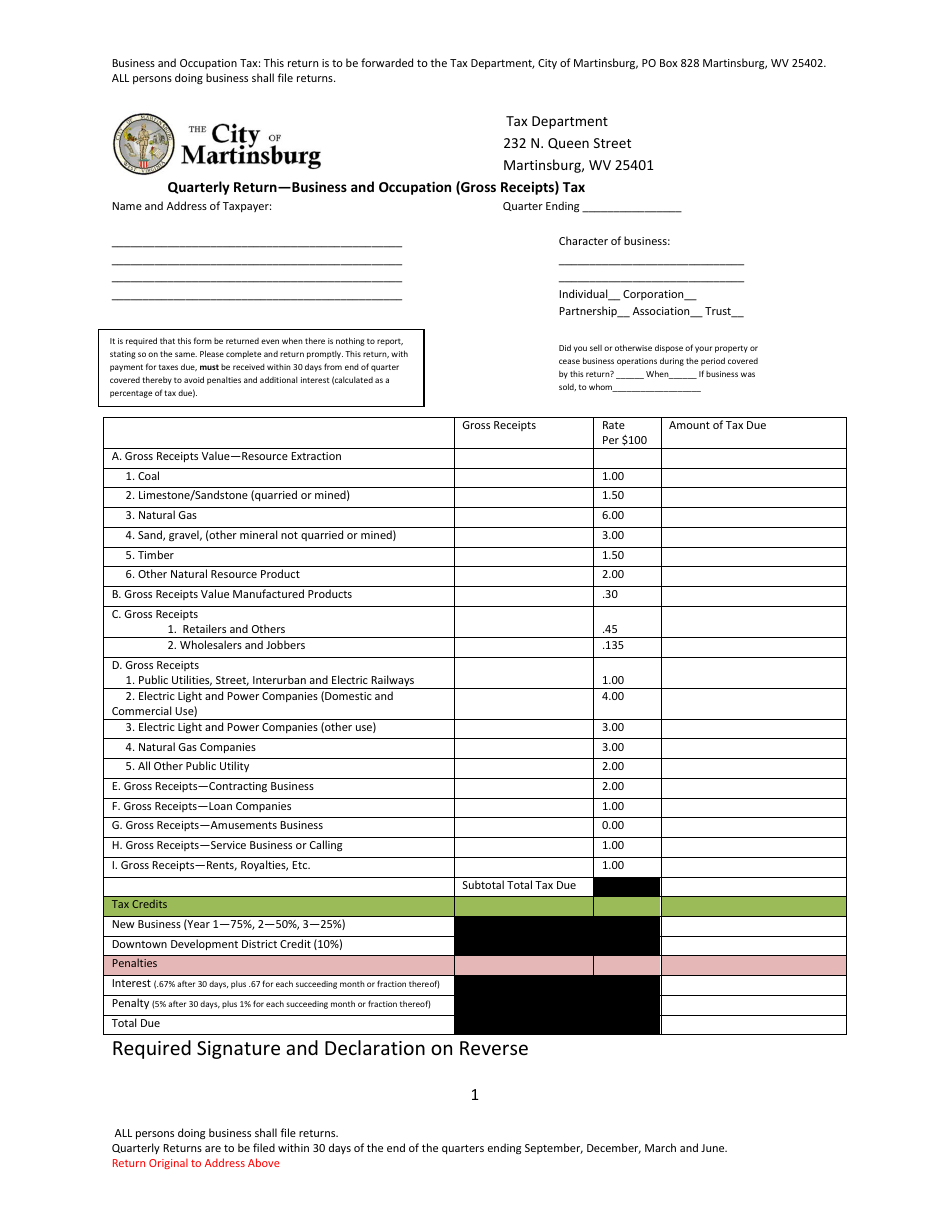

Rates vary according to the type of business and differ from city to city. The West Virginia municipal BO tax is a gross receipts tax with no deductions whatsoever allowed. 409 S Kanawha Street.

Gross income or gross proceeds of sales derived from sales within West. Government City Departments Finance Department. Events News Updates.

Tax Return Form Businesses choose. The city is currently in the process of developing an online method for paying your BO taxes that should be available soon. Business Occupation Tax.

247 304-264-2136 Fax Email. The West Virginia Municipal Business and Occupation Tax BO Tax is an annual privilege tax imposed on all persons and entities doing business in West Virginia municipalities. 1 Wall Street Ravenswood West Virginia 26164.

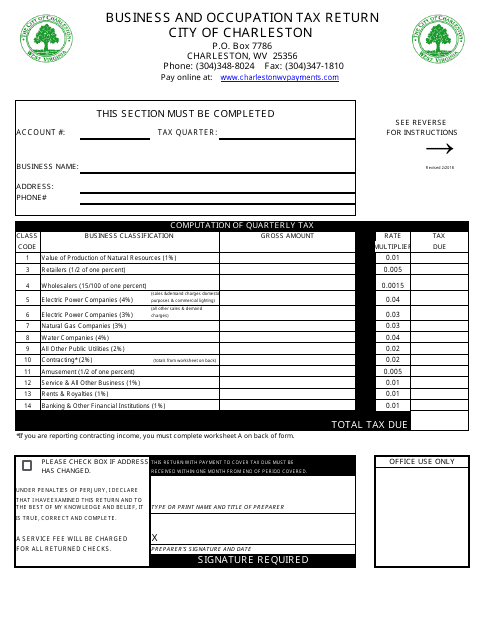

Return by the due date to avoid delinquent notices and tax assessments. Determine you Charleston BO taxable gross income for each of the classifications and enter it. Determine your Business Classifications and corresponding rates from the tax table.

PO Box 2514 Beckley WV 25802. All persons engaging in business. The City of Clarksburg has business and occupation tax charged on gross revenues of every entity conducting business within the corporate limits of this.

The main revenue source for West Virginia cities is the business and occupation tax generated by any commercial activity locate within the City limits. Washington unlike many other states does not have. B O Tax.

For assistance call 3046965540 press option 4 for the Finance Division BO TAXES WAIVED FOR RETAIL. BOT-300G Tax for Gas Storage. Tax Information and Assistance.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. The following general principles determine tax liability under the municipal BO Tax. Business Occupation Tax.

Our City is always growing so use the information here to assist you. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by. The state BO tax is a gross receipts tax.

Martinsburg WV 25401 304-264-2131 Ext. Of these 117 impose a business and occupation tax in some form and the other 117 municipalities do not impose a business and occupation tax. Municipalities that do not impose.

Schedule I-EPP Industrial Expansion or. State of West Virginia Website. Information on BO Taxes for Charleston WV.

The second years B and O Tax would be on 20000 75 credit on the difference between year before expansion and second year after expansion and B and O Tax in the third year would be. There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount.

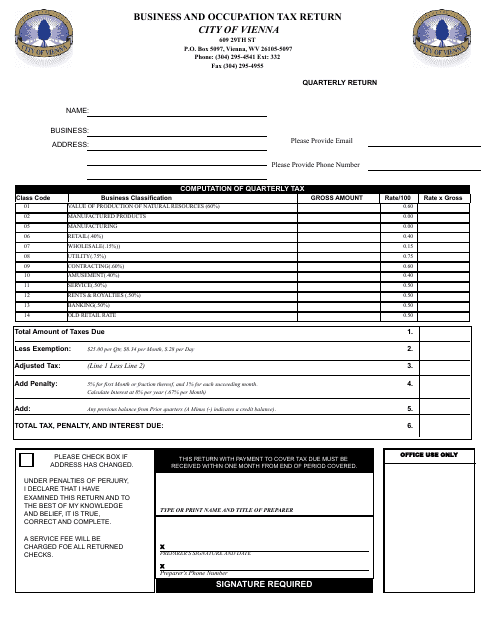

City Of Vienna West Virginia Business And Occupation Tax Return Download Fillable Pdf Templateroller

Business Occupation Tax Clarksburg Wv

Wv Gross Sales Tax Fill Out Tax Template Online Us Legal Forms

Co 8016 Chesapeake Ohio C O Emd F7 A At Petersburg West Virginia By Bnsf Es44dc Railroad Photos Railroad Photography West Virginia

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

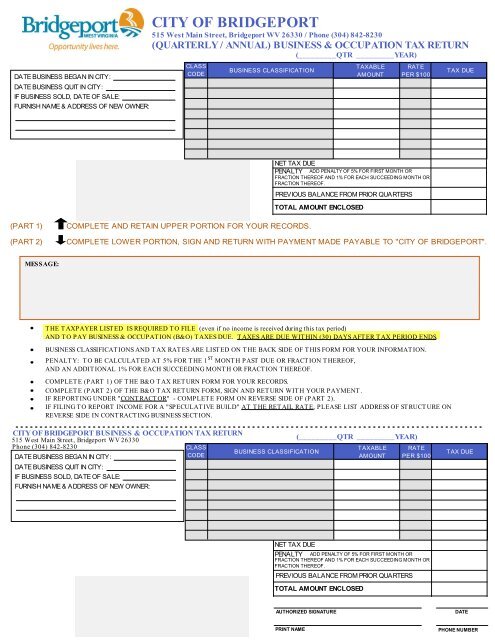

Business Amp Occupation Tax Return Rates City Of Bridgeport

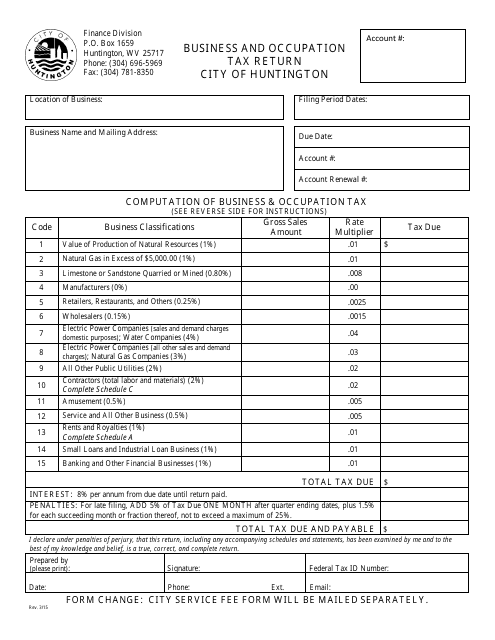

City Of Huntington West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

Mayor Of St Albans Voices Concern Over House Bill Cutting Certain B O Tax Wchs Network News Sports Business Charleston Wv

The Charleston Tax Shift Is It Worth It West Virginia Center On Budget Policy

Business In Marlinton Town Of Marlinton

West Virginia Governor S Income Tax Elimination Plan Is Met With Misinformation Misdirection

Pin By H H On Books West Virginia Virginia True Crime

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

West Virginia Quarterly Return Business And Occupation Gross Receipts Tax Download Fillable Pdf Templateroller

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller